Preparing for the 2020 Tax Season

- - By : aqn

- Date : 15-Dec-20

First of all, we hope you and your families are healthy and safe. This year brought challenges and disruptions that significantly impacted your personal and financial situations – COVID-19, economic relief measures, new tax laws and political shifts. Now is the time to take a closer look at your current tax strategies to make sure they are still meeting your needs and take any last-minute steps that could save you money.

With the elections in Georgia yet to be determined, there is a lot of tax reform speculation. The general consensus seems to be that there will not be sweeping income tax changes; however, tax rates are likely to rise over the next few years, so that should be considered as part of your tax planning analysis.

In addition to income tax changes, there could be significant changes to the estate tax regime coming soon. Please call if you have not discussed your estate plan with your lawyers or us recently.

The following is a look at some issues to consider as we approach year-end.

Charitable Deductions

Unique to 2020, individuals who do not itemize their deductions can take an above-the-line charitable deduction of up to $300. Such contributions must be made in cash and made to qualified organizations.

Unique to 2020, individuals who do not itemize their deductions can take an above-the-line charitable deduction of up to $300. Such contributions must be made in cash and made to qualified organizations.

For those itemizing, the adjusted gross income limitation for cash donations was increased to 100% for 2020 (excluding Sec. 509(a)(3) supporting organizations and donor-advised funds, for which the limitation remains at 60%).

Consider gifting appreciated securities rather than cash. When you gift appreciated securities, you receive a charitable deduction for the fair market value of the securities without having to recognize the capital gain on your return. The adjusted gross income deduction limitation for property donations remains at 30% for 2020.

Retirement Accounts

If you are a qualified individual you may be able to take up to $100,000 in coronavirus-related distributions from retirement plans through the end of the year without being subject to the 10% additional tax for early distributions. The tax on qualified distributions can be paid over three years.

If you are a qualified individual you may be able to take up to $100,000 in coronavirus-related distributions from retirement plans through the end of the year without being subject to the 10% additional tax for early distributions. The tax on qualified distributions can be paid over three years.

Additionally, required minimum distributions (RMDs) are temporarily suspended for 2020. If your retirement assets have taken a hit, not having to take an RMD may allow those assets to recover some value before you liquidate them.

Those of you that have experienced deductible losses from flow-through business activities for 2020, or otherwise have an NOL carryforward, you may want to consider converting traditional IRA funds to Roth IRAs. If you have recognized business losses, the income on such a conversion could be offset by those losses. Roth IRA conversions can also be used to take advantage of lower tax brackets and insure you utilize all of your itemized deductions, if applicable.

Review Your Investment Portfolio

Review your holdings to determine if you need to rebalance and take advantage of any tax planning opportunities at the same time. For example, if you have an overall capital loss for the year you could sell some gain positions to offset the loss and then buy back the same asset you sold to create the gains. This strategy can reduce your capital loss carryforwards, increase your income to desired levels, and step-up up your basis in assets that you want to hold.

Review your holdings to determine if you need to rebalance and take advantage of any tax planning opportunities at the same time. For example, if you have an overall capital loss for the year you could sell some gain positions to offset the loss and then buy back the same asset you sold to create the gains. This strategy can reduce your capital loss carryforwards, increase your income to desired levels, and step-up up your basis in assets that you want to hold.

Business Income And Expense Planning For Cash Basis Activities

Review your yearend receivables and upcoming expenditure needs. IRS regulations contain a safe-harbor rule that allows cash-basis taxpayers to prepay and deduct qualifying expenses up to 12 months in advance without challenge, adjustment, or change by the IRS.

Review your yearend receivables and upcoming expenditure needs. IRS regulations contain a safe-harbor rule that allows cash-basis taxpayers to prepay and deduct qualifying expenses up to 12 months in advance without challenge, adjustment, or change by the IRS.

Under this safe harbor, your 2020 prepayments cannot go into 2022. This makes sense, because you can prepay only 12 months of qualifying expenses under the safe-harbor rule. Don’t surprise your landlord by paying all of next year’s rent, as they would need to recognize the income this year, but you could consider prepaying subscriptions or stocking up on supplies.

Consider purchasing company assets that will be need in the near future. We do not promote purchasing assets just to reduce your tax liability, but with today’s 100% bonus depreciation and increased Section 179 deductions you may be able to fully deduct the cost in 2020 if the assets are received and placed into service (used) prior to year-end.

Purchases on credit cards are considered paid for when charged, even for cash basis taxpayers. As such, using your credit card to pay upcoming bills can secure your 2020 tax deduction and allow you to defer the cash payment until 2021.

Please note that these strategies can create a snowball effect, reducing next year’s deductions or requiring you to take similar measures on an ongoing basis.

Paycheck Protection Program

If your business received a payment from the paycheck protection program the related expenses are currently thought to be nondeductible. The American Institute of Public Accountants and other groups continue to advocate for the deductibility of these expenses. If the expenses end up being deductible the cash receipts would not be taxable and the business owners would be able to deduct all the related costs, a most favorable outcome.

If your business received a payment from the paycheck protection program the related expenses are currently thought to be nondeductible. The American Institute of Public Accountants and other groups continue to advocate for the deductibility of these expenses. If the expenses end up being deductible the cash receipts would not be taxable and the business owners would be able to deduct all the related costs, a most favorable outcome.

As a reminder, eligible employers are entitled to receive a payroll tax credit in the full amount for the wages paid for qualified sick leave and family leave offered through the Families First Coronavirus Response Act (FFCRA) which was taken during the period beginning April 1, 2020 through December 31, 2020. This credit is allowed against the Social Security and Railroad Retirement tax (IRC §3111(a) and §3221(a)) on all wages and compensation paid to the affected employees. If the amount of the credit exceeds the employer portion of these federal employment taxes, the excess is treated as an overpayment and can be refunded to the employer.

State Tax Obligations Related To Teleworking Arrangements For Employees

As the COVID-19 outbreak continues, many employers are encouraging or requiring their employees to work from home (i.e., telework). Such remote working arrangements could potentially have tax implications that should be considered.

As the COVID-19 outbreak continues, many employers are encouraging or requiring their employees to work from home (i.e., telework). Such remote working arrangements could potentially have tax implications that should be considered.

Importance Of Retirement Planning

We recommend you review your retirement situation at least annually. That includes making the most of tax-advantaged retirement saving options, such as traditional IRAs, Roth IRAs and company provided retirement plans. Depending on your age and income level a Roth conversion may be advisable. It’s also advisable to take advantage of health savings accounts that can help you reduce your taxes and save for your future.

Virtual Currency/Cryptocurrency

Virtual currency transactions are becoming more common. There are many different types of virtual currencies, such as Bitcoin, Ethereum and Ripple. The sale or exchange of virtual currencies, the use of such currencies to pay for goods or services or holding such currencies as an investment generally has tax consequences.

Virtual currency transactions are becoming more common. There are many different types of virtual currencies, such as Bitcoin, Ethereum and Ripple. The sale or exchange of virtual currencies, the use of such currencies to pay for goods or services or holding such currencies as an investment generally has tax consequences.

Fraudulent Activity Remains A Significant Threat

Our firm takes security seriously and we think you should as well. Fraudsters continue to refine their techniques and tax identity theft remains a significant concern. Beware if you:

- Receive a notice or letter from the Internal Revenue Service (IRS) regarding a tax return, tax bill or income that doesn’t apply to you

- Get an unsolicited email or another form of communication asking for your bank account number or other financial details or personal information

- Receive a robocall insisting you must call back and settle your tax bill

Make sure you’re taking steps to keep your personal financial information safe. Let us know if you have questions or concerns about how to go about this.

Please also continue to send us sensitive information using the secure upload link on our home page.

There are many other opportunities to discuss as year-end approaches. We are here to help. Please call with any questions so we can discuss your specific situation.

New IRS Tax Audit Rules for Partnerships (including LLCs taxed as partnerships)

- - By : contentmaster

- Date : 13-Feb-19

February 11, 2019

IRS Tax Audit Rules for Partnerships (including LLCs taxed as partnerships)

The Bipartisan Budget Act of 2015 (“Act”) made significant changes to the Internal Revenue Service’s partnership audit rules effective for partnership tax years beginning in 2018. How the new audit rules will affect a partnership and its partners will depend, in large part, on choices the partnership, the partnership representative, and/or the partners make or fail to make. The changes are expected to dramatically increase the audit rates for partnerships and will require partners to carefully review, if not revise, their partnership’s operating agreement.

Careful planning today will help mitigate any unfavorable consequence.

Important new provisions that may impact you:

• The IRS may collect any additional tax, interest, and penalty directly from the partnership rather than from the

partners (the tax could be collected at the highest individual tax rate).

• Current partners could be responsible for tax liabilities of prior partners.

• New elections and opt-outs will be available and your agreement may need revision to specify who makes these decisions.

• There are many new tax terms and concepts that will likely require you to adjust your partnership’s operating agreement.

New Partnership Representative Role

Under the new rules, the designated partnership representative has the “sole and exclusive authority” to act on behalf of the partnership and to bind all partners with respect to partnership matters subject to the partnership audit rules. This authority includes, but is not limited to, making relevant elections, representing the partnership during an audit, negotiating and agreeing (or disagreeing) to settle with the IRS, and seeking judicial review of an IRS adjustment. In the absence of an appointed person, the IRS has the discretion to pick a partnership representative; therefore, partnership and LLC agreements should be revised to specify who will act as the partnership representative.

Available options for Partnerships to “elect out” of the new audit rules

Small partnerships (100 or fewer eligible partners) may choose to “opt out” of the new partnership audit rules by making an annual election on a timely filed Form 1065 for the applicable tax year. The option to “opt out” of a partnership level audit is not available to any partnership that has trusts or partnerships (including LLCs taxed as partnerships) as partners.

Another option, the “push out” election, is available to partnerships once a notice of final partnership adjustment is issued. The partnership would need to make a timely election within 45 days of receiving a notice of final partnership adjustment to “push out” the assessment to the individuals that were partners during the audited tax year. This election comes at a cost. The rate of interest assessed on underpaid taxes rises two percentage points if this election is utilized; however, the increased interest rate may be acceptable if the current ownership is different than the year audited.

Under the options detailed above, the partnership would pass through the tax adjustment to the persons who were partners during the audited tax year by issuing amended Schedules K-1. Each partner receiving an amended Schedule K-1 would be required to amend their returns for the audited tax year.

Items requiring your attention:

• Discuss this information with your fellow partners/members;

• Choose a Partnership Representative;

• Contact your lawyer to update the partnership agreement and/or LLC operating agreement, as needed;

• Once the partnership agreement has been updated, have your lawyer provide us a complete copy of the partnership / LLC

agreement including all amendments, thereto.

Please call us if you would like to discuss these new partnership changes and review your planning opportunities.

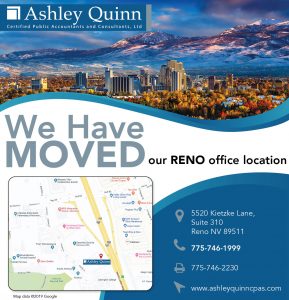

OUR RENO OFFICE HAS MOVED!

- - By : contentmaster

- Date : 10-Feb-19

2025 UPDATE — We moved again!

Click for details, we’re now at 540 W. Plumb Lane, Suite 110.

Original post from our move in 2019:We are now open in our new South Reno location, just south of the Kietzke Lane and Neil Road roundabout. If you are in the area, please stop by to say hello!

SIMPLY TAXES Beware! Appraisal Required

- - By : aqn

- Date : 21-Mar-17

Using appreciated stock held over a year to fund a significant contribution to a public charity instead of cash can result in a “double play”. You can get the benefit of a deduction equal to the full fair market value of the shares and at the same time avoid paying capital gains tax on the appreciation.

Making a charitable contribution using publicly traded stock is fairly simple. For contributions of more than $5,000, you must attach Form 8283 with a description of the shares contributed, their fair market value, how you acquired the shares and your cost basis. In addition, as is true for all contributions over $250, you must obtain written contemporaneous acknowledgement of your contribution from the charity, which must include a statement that you did not receive anything of value in return for making the contribution.

The same result can be attained with a charitable contribution of non-publicly traded shares. However, for gifts valued at more than $10,000, there is an additional requirement. In order to secure a deduction, you must get a “qualified appraisal”. A qualified appraisal is a complex and detailed document, which must be prepared and signed by a “qualified appraiser”. While it generally does not have to be attached to your tax return, the appraisal must be obtained before the due date, including extensions, for filing your income tax return on which the deduction is claimed.

We are often asked about charitable contributions involving non-publicly traded stock and business interests, where the appraisal requirement seems redundant and completely unnecessary. Consider a contribution of an interest in a partnership whose units are freely exchangeable for shares of publicly-traded stock; or, a contribution of shares in a corporation whose shareholders are subject to a “buy-sell” agreement, which clearly sets the value of the shares; or, a contribution of shares in a closely-held corporation whose shares have traded in many arms-length transactions during the year. Unfortunately, even when an appraisal is redundant, the Code and Regulations strictly require that you get an appraisal.

What if you have made a significant charitable contribution of appreciated non-marketable securities in 2016 and you have not yet obtained a qualified appraisal? You should consider requesting an extension to file your 2016 income tax return before the April 18, 2017 deadline, so you have until October 15 to get your qualified appraisal. No appraisal means no deduction, or at best, your deduction will be limited to your cost basis instead of the fair market value.

CONSULT YOUR TAX ADVISER — this article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation. George Ashley is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He may be reached at 775-831-7288, and welcomes comments at [email protected].

Foreign Financial Account Reports Due Soon!

- - By : aqn

- Date : 21-Jun-16

All deadlines have more or less equal implications, but some deadlines are more equal than others. This one looms – no later than June 30 upcoming!

By law, many U.S. folk with foreign accounts exceeding certain thresholds must file Form 114, “Report of Foreign Bank and Financial Accounts” (aka “FBAR”) electronically with the Treasury Department’s Financial Crimes Enforcement Network (“FINCEN”).Read More

No Surprise: Social Security Just Doesn’t Measure Up

- - By : aqn

- Date : 13-Jun-16

We’ve been preaching that note for decades – but some folk just don’t seem to get it, and refuse to look after their own savings needs, expecting they will be spending each summer on the Riviera. It just doesn’t work that way.

The Tax Foundation has a good recent report on the matter, which those who don’t believe us may want to scrutinize. Recalling that Social Security benefits alone are simply not adequate to replace retirement income, millions of Americans just save too darned little to support their preretirement living standard when the time comes to stop working. Indeed, many folk have exactly zero retirement savings, in the form of an IRA or other tax-favored retirement plan! Can you believe it?!Read More

IRS Commish Heading For Early Retirement?

- - By : aqn

- Date : 18-May-16

Seems as if that’s pretty much how it’s looking – the House Judiciary Committee has scheduled hearings to examine alleged misconduct by Commish Koskinen, we hear. On May 24 (just next week) the Judiciary Committee will hear the findings of the House Oversight and Government Reform Committee’s investigation of the Chief Revenooer!

Congressman Jim Jordan (R-Oh) has expressed his view thusly: “I applaud Chairman Goodlatte’s decision to hold hearings on the resolution for impeachment of IRS Commissioner John Koskinen. Commissioner Koskinen failed to fulfill his duty to the American people by allowing back-up tapes containing potentially 24,000 emails to be destroyed. He failed to inform Congress about the destruction of these back-up tapes in a timely manner……Alexander Hamilton wrote in the Federalist papers that impeachment should be used to protect the public against ‘the abuse or violation of some public trust.’ Commissioner Koskinen has most assuredly violated the public trust…….”Read More

Celebrate Your Freedom!

- - By : aqn

- Date : 03-May-16

Tax Freedom, that is! You actually just achieved it about a week ago, according to the Tax Foundation. “Tax Freedom Day” 2016 just passed – on April 24, or 114 days (not counting “Leap Day”) into the new year. And indeed, “Freedom” comes one day earlier than last year!

That’s the good news. You will mope when you hear that Americans will spend more on taxes in 2016 than they will on food, clothing, and housing combined! And when you include Federal borrowing, Tax Freedom Day won’t hit until May 10! (The latest ever deficit-inclusive Tax Freedom Day occurred during World War II – on May 25, 1945.)Read More

IRS: No Deduction For Spiffy Duds!

- - By : aqn

- Date : 07-Mar-16

So you think the fact that you spend some big bucks on the clothes you wear to work – in order to impress your customers and others – is reason enough to have Uncle Sam subsidize your expenditure.

Not so, say the Revenooers, as most recently expressed in the Tax Court case of Sofien Beltifa. This guy was employed by a restaurant in New York City in 2011 as a bartender/manager. His duties included “calling in” liquor orders, taking liquor deliveries, and ensuring that the bar was fully stocked at all times. The restaurant did not require its employees to wear a uniform, though it did request employees to wear an all black ensemble (shirt, tie, pants) while working. The taxpayer believed it was necessary to look his best because he was one of the faces of the restaurant. “When you enter, you just see me and then you walk through,” he testified. “You see the host, you see me. I’ve got to look presentable.”Read More

Revenooers Reveal This Year’s “Dirty Dozen” Tax Scams

Always vigilant to the endless raft of tax shenanigans going on out there, IRS has released its latest list of favorites – warning taxpayers to be alert to the most egregious potential problems lurking.

- Identity theft – This is the biggie. IRS continues to hunt down and prosecute the crooks filing false tax returns using other folks’ social security numbers to secure refunds to which the bad guys are not entitled.

- Phone scams – We’ve even received one of these – a call from a bad guy impersonating a real Revenooer claiming that unless we pay (a phony “unpaid tax” amount) arrest and other bad things awaits us.

- Phishing – Though IRS never communicates with taxpayers about unpaid balances, the bad guys do, in an effort to steal personal information. IRS warns you to be wary of strange emails and websites that are likely nothing more than invitations which, if accepted, will expose your personal information to theft.

- Return preparer fraud – Deal with reputable professionals only, and beware of preparers, for example, who may pop up with a store front near you, promising all kinds of tax goodies if you engage them.

- Offshore tax avoidance – IRS has gotten pretty good at nipping this one in the bud, but some folks still think they can hide assets and/or income abroad, keeping IRS at bay. This can be really bad medicine and folks who play this game will find their pocket book much lighter if/when IRS catches up, not to mention the possibility of a stay in the slammer.

- Inflated refund claims – Stay away from any preparer who asks you to sign a blank return, promises a big refund before even reviewing your records, or charges fees based on a percentage of your refund!

- Fake charities – Make sure your donations go to only legit charities and not ones with “sound alike” names to those we all know and love. If in doubt, check with IRS first (www.irs.gov) who keeps a list of all charities which are truly tax exempt organizations.

- Falsely padding deductions on returns – this one speaks for itself. Obviously a “no-no.”

- Excessive claims for business credits – The fuel tax credit and research credit are high on IRS list of those credits which often are used by cheaters.

- Falsifying income to claim credits – IRS warns you not to “invent” income so you can incorrectly qualify for such items as the earned income tax credit!

- Abusive tax shelters – This one, too, used to be of more concern to IRS, which has become pretty good at shutting down these tax avoidance schemes, and even putting some of the folks pushing them in the clink. If a peddler tries to sell you on one of these, and it “sounds too good to be true,” the likelihood is that it is.

- Frivolous tax arguments – Believe it or not, there are still some promoters out there who try to encourage taxpayers to make unreasonable and outlandish claims (often based on phony constitutional arguments, or claiming that the income tax law is illegal) in an effort to reduce one’s tax liability. Amuse yourself by reading about these blokes and their ridiculous arguments, but that should be as far as you go. And by the way, the penalty for filing a frivolous return is $5,000.Read More

New Rule: IRS No Longer Hires Tax Cheats

Comforting, isn’t it? To learn that IRS has adopted policies that prohibit its employees who cheat on their own taxes to work for Uncle Sam!

“I have no indication that anyone working for the IRS has not followed the updated procedures,” quoth Commish Koskinen in recent testimony before the Senate Finance Committee.

Recall that a report last year by the Treasury Inspector General for Tax Administration (TIGTA) found that 1,580 IRS employees had willfully failed to pay their taxes. Of those, TIGTA found 61 percent retained their jobs.Read More

Magnanimous Obama Proposes Retirement Savings Incentives

REVENOOER RANTS – 2/8/16

Lest we be chastised for not giving credit where credit is due, we have to hand it to Obama for recently announcing much needed retirement incentives which will be included in his 2017 budget to be announced this week. The simple fact is that, unlike the situation in our parents’ generation, most folks just don’t work their entire career with one company, which typically stashed away dough to fund employees’ retirement years. Further, Obama notes that fewer than 10% of workers without access to a workplace retirement plan contribute to a retirement savings plan of their own. So, government now proposes to encourage more employers to offer plans and create alternative savings arrangements for folks whose employer does not offer a plan. To wit:

- A proposal to triple the existing “startup” credit so small employers which begin offering a retirement plan would receive a tax credit of $1,500 per year for up to three years. Further, small employers which already offer a plan and add auto-enrollment would get a tax credit of $500 per year for up to three years.

- For the benefit of part-time workers, a proposal to require that employees who have worked for an employer for at least 500 hours per year for at least three years be eligible to participate in the employer’s existing plan.

- A proposal which would require employers with more than 10 employees who do not presently offer a retirement plan to automatically enroll their workers in an IRA. Employers with 100 or less employees that offer an auto-IRA would receive a tax credit of up to $3,000.

- A proposal to increase the “portability” of retirement savings, in cases of employees who change employers through the course of their working life.Read More

Tax Court Reiterates Employee/Independent Contractor Distinction

Seems like an issue which just won’t go away – the question of whether a worker bee is an employee, or an independent contractor. Makes a big difference in how the bloke reports his expenses. If he’s an employee, those expenses go on Schedule A as itemized deductions, and are likely to be subjected to some limitations in the deductible total. If he’s a contractor, the expenses go on his Schedule C, and further any net profit he reports there can qualify him for retirement plan deductible contributions as well.

So here comes taxpayer Jorge Quintanilla who, the Court notes, is an exceptionally skilled production worker on approximately 150 commercials shot in Southern California. Jorge believed he qualified as a contractor and reported his expenses on Schedule C as noted above. The Court further notes that the legal distinction between an independent contractor and a common-law employee is settled as a general matter, though it’s often murky in application. Courts of various stripes, however, have set forth certain factors over the years, intended to guide one to the proper conclusion as to employee versus contractor, including:Read More

Cat Grabs IRS’ Tongue

Seems the Revenooers plan to go silent – they just don’t want to talk to you anymore.

The National Taxpayer Advocate, in her recent report to Congress, notes that for the past year and a half, IRS has devoted significant resources to creating a “future state” plan which details how the agency will operate in five years. The plan is explained and developed in a document known as a Concept of Operations (CONOPS).

But CONOPS gives the Advocate a bit of heartburn – implicit in the plan (and explicit in internal discussion) is an intention of the part of the Revenooers to substantially reduce telephone and face-to-face interaction with taxpayers. IRS is hoping that taxpayer interactions with IRS through online accounts will address a high percentage of taxpayer needs.

Consider:

- Taxpayers place more than 100 million telephone calls to IRS each year and have done so in every year since fiscal year 2008.

- Taxpayers make more than five million visits to IRS walk-in sites each year.

- Taxpayers send an average of about ten million pieces of correspondence to IRS in response to proposed adjustment notices each year, to which IRS must respond.

Seems the Advocate thinks that if IRS substantially reduces the opportunity for folks to actually talk with IRS employees, many taxpayers will find it much harder to resolve their problems and will have to pay third parties to assist them. (No doubt!) Hence, the Advocate has recommended to Congress that IRS make the CONOPS available for public review and comment (heretofore not done). Indeed, the Advocate has designated the future of taxpayer service (an oxymoron if ever there was one) as the number one most serious problem presently confronting taxpayers. Quoth the Advocate: “Of considerable concern….is what is not stated in the CONOPS. Nowhere in the CONOPS is there a statement that the IRS plans to reduce telephone service or close walk-in sites, even though that is a central component of its strategy……The widespread expectation is that traditional taxpayer services – telephone assistance and face-to-face assistance – will be scaled back dramatically. Based on our internal discussions with IRS officials, Taxpayer Advocate Service has been left with the distinct impression that the IRS’s ultimate goal is ‘to get out of the business of talking with taxpayers.’”

Who knows – maybe this is a good thing.

And the latest from Hillary, this week: a proposed 4 percent ‘fair share surcharge’ tax on the wealthy – now defined as folks making more than $5 million per year.

“This surcharge is a direct way to ensure that effective rates rise for taxpayers who are avoiding paying their fair share, and that the richest Americans pay an effective rate higher than middle-class families,” says a Clinton aide.

We’d call this a “broken record” argument, but who knows what vinyl is any more.

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article is a CPA recently retired from the firm of Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments at [email protected].

Watch out for “Hillarytax”

So, here we go – head first into another election year! And you Hillary fans, out there, should not forget her recent promise to go even beyond Obama’s desired tax schemes, and “to make sure the effective tax rate paid by millionaires reflects a truly fair tax system,” according to one of her aide’s recently.

Recall that Obama, once upon a time, propounded the so-called “Buffett Rule” (named for his buddy, Warren Buffett, billionaire investor.) Obama thinks taxpayers with adjusted gross incomes exceeding $2 million should pay a minimum tax rate of 30% – vastly higher than the rate applicable to various forms of investment income presently taxed at a top rate of 23.8%.

“The Buffett Rule says that millionaires should pay at least 30% income tax rates….and I want to go even farther,” chirped Hillary recently. “I want to be the president of the struggling, the striving and the successful.”

Nice.

And obviously former Congressional Budget Office Director Doug Elmendorf likes Hillary’s prescription. Quoth Doug, “If we make changes to federal spending and taxes, we should make them in ways that impose most of the burden on the affluent, because those are the people who have benefited the most from growth in output and income over the past few decades.”

Unstated by Dougie: those are also the folks who take the risks and invest the capital which fuels growth and provides jobs, whom he and Hillary would propose to punish.

And isn’t it time somebody stood up to the morons pleading for abolition of the IRS? We hold the Revenooers in as low esteem as anybody, but let’s get real. Even National Taxpayer Advocate Nina Olson, in recently suggesting that IRS could, indeed, be smaller, points out the notion that the agency could be abolished is basically impractical.

“I don’t know how people think that would happen,” quoth Nina. “People talk about, ‘Oh, all we need is a postcard’ (to file taxes on). Well, you’re going to need some agency that you send a postcard to, and you’re going to need some employees to process that postcard.”

Not to mention someone to administer the system’s complex laws and regulations.

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is retired from the firm of Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments at [email protected].

IRS Hangs Tough On IRA 60 Day Rollover Rule

We’ve reported, many times, about various situations in which beleaguered taxpayers have been unable to meet the requisite 60 day IRA rollover rule (to avoid treating the dough coming out of the IRA in the first instance to be taxable), and IRS has bent over – showing its “kinder and gentler” side and not slapping the taxpayer with penalties. Most of these cases have fact patterns indicating the delinquency was not the taxpayer’s fault, but often times that of the IRA custodian because of that guy’s administrative delays.

But in a recent private letter ruling, IRS refused to waive the 60 day rollover requirement for a taxpayer whose attempt to use an IRA distribution to buy an interest in a partnership failed because the IRA custodian couldn’t hold the interest – a mistake that the taxpayer did not learn of for almost a year. In response to the taxpayer’s plea that the timeliness failure was due to his receipt of incorrect advice, IRS hung tough on the notion that the failure was in fact due to his decision to use IRA proceeds to fund a business venture.

IRS will consider several factors in determining whether to waive the 60 day rollover requirement, including time elapsed since the distribution, inability to complete the rollover due to death, disability, hospitalization, incarceration, restrictions imposed by a foreign country, postal error, errors committed by a financial institutions, etc.

In this case, the taxpayer’s financial advisor prepared the paperwork for the taxpayer to sign, and on November 21, 2012, the custodian issued a check payable to the partnership. The taxpayer intended that his IRA purchase the shares, and that they be held by the custodian.

But as it turned out, due to some technicality in the partnership agreement, the custodian was eventually unable to hold the investment on behalf of the IRA. The taxpayer believed that the financial advisor should have prepared paperwork to transfer the amount to a financial institution that could have held the partnership interest on behalf of the IRA. The problem was not discovered until October of 2013 – obviously well beyond the 60 day rollover period.

Right or wrong, IRS conclusion, here, was that taxpayer’s failure to complete a timely rollover wasn’t due to any of the factors described above which have been held in the past to constitute valid excuses, but instead was due to his choice to use the IRA proceeds to fund a business venture.

Result: taxpayer is forced to include the distribution in his taxable income for 2012.

And did you hear the latest from Hillary’s campaign re her tax proposals? $250 billion in direct “investment” over the next five years. Plus an additional $25 billion to fund a “national infrastructure bank.” None of this dough comes from the “middle class,” of course, whose taxes Hillary would “cut.” Hillary wants to give those folk “a raise,” while she hits the top 3% of earners to pay for all of this largesse.

Heard that one before? How much is enough?

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments at [email protected].

Revenooers Comin’ After High Earners!

And the Treasury Inspector General for Tax Administration (TIGTA) doesn’t like the IRS’ “MO”.

In its most recent audit report, last week, TIGTA notes that IRS has taken steps to improve its audit coverage of high-income taxpayers. But it should reevaluate whether the threshold of $200,000 for its High-Income and High-Wealth strategy results in an efficient allocation of audit resources.

Translation: “Doesn’t everybody make $200,000 or more each year?”

TIGTA says that because IRS is devoting more audit resources to these taxpayers, it is important to know at what level of income or wealth taxpayers tend to begin establishing complex financial holdings that are at greater risk for noncompliance with the law.

IRS’ High-Income and High-Wealth strategy devotes nearly 50 percent of its high-income audits to taxpayers earning $200,000 to $399,999, whose tax returns potentially present the least productivity of all high-income taxpayers, says TIGTA.

“The IRS should reevaluate the income level it uses to identify taxpayers for its High-Income and High-Wealth strategy so that it can better allocate audit resources to the most significant audit risks,” says J. Russell George, TIGTA major domo.

The IRS Large Business and International Division (LB&I) established the Global High Wealth (GHW) Industry, which takes a comprehensive approach in auditing high-income taxpayers by extending audits beyond the individual tax return to the entities which these taxpayers control.

But IRS is using resources from three other LB&I industries to assist with auditing GHW cases, though no evaluation has been made regarding the impact of that decision on those other industries. Further – and importantly – IRS cannot quantify its GHW audit performance because of limitations of IRS audit information systems, and GHW has not implemented a quality review process for its audits.

And you can thank Obama for recently eliminating a process (the “file and suspend method” of claiming Social Security benefits) via recent legislation which will nix this strategy used by married folk to maximize their lifetime benefits.

Under this approach, a higher earning spouse would claim benefits at his full retirement age (presently 66) but suspend the benefits until a later date allowing the Social Security credits to continue to grow. The lower earning spouse would then claim benefits based on the higher earning spouse’s earnings record, which would be more than the benefits based on his or her own earnings record. The new rules eliminate this opportunity for claims filed after April 30, 2016.

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments at [email protected].

No Penalty Despite Taxpayer’s 5th Amendment Claim

Some folks we’ve run into have a hard time with the questions on the individual tax return regarding the existence of foreign bank accounts. “None of their business!” claim some, even though the law says that it sure is.

So here comes taxpayer Youssefzadeh who asserted his 5th amendment protection against self-incrimination in objecting to provide certain info called for on Schedule B of his 2011 tax return. Along come the Revenooers, however, slapping our boy with the $5,000 frivolous return penalty, which the law requires in cases where the return doesn’t contain info on which the substantial correctness of the self-assessed tax may be judged. Even though his return did include the numerical information, including the total amount of interest income which he received for the year.

“Whoa,” said the Tax Court, in concluding that indeed the return was not frivolous. Indeed, noted the Court, the document filed by the taxpayer did contain sufficient information for IRS to judge “the substantial correctness of the self-assessment.” The Court found that the return was sufficient to determine its substantial correctness – which doesn’t necessarily require that It be “completely correct.” The Court noted that the total amount of interest was included on the return, thus distinguishing Youssefzadeh from other tax protestors who merely fill out a return with zeroes on every line.

Anyway, we don’t advise folks to just ignore information requests on returns (like the queries about foreign bank accounts). This guy may have avoided the frivolous return penalty in his case, but playing fast and loose with the foreign financial account requirements presently permeating the law often is just asking for trouble.

And here’s a novel idea – advanced by Congressman Andy Harris (R-Md) whose recent bill would permit individuals to prepay their federal estate tax during their lives by increasing their income tax obligation by one percent of their adjusted gross income, generally, and foregoing basis adjustments at death.

The estate tax would be avoided only if the taxpayer paid at least seven years of additional income tax. If the bloke otherwise dies fewer than seven years after making the election, the taxes paid would be allowed as a credit against the estate tax liability.

Sounds like one Bernie would favor, don’t ya think?

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments at [email protected].

Don’t Forget to Sign the Darned Return!

So you go through all the hassle of getting your records together and getting that return assembled, but at the eleventh hour, you send that joint return to the Revenooers without having your spouse sign the darned thing.

Bad Karma – as learned the hard way by taxpayers Mr. and Mrs. Reifler, who the Tax Court recently slammed down hard as technically not having actually filed a timely return at all in the circumstances!

Mr. and Mrs. Reifler, you see, were married folk who even employed an accountant to prepare their returns. Mr. Reifler had significant business experience. For tax year 2000, Mr. Reifler signed the return and left it for the Mrs. to sign but she didn’t – for whatever reason. Mr. Reifler didn’t notice the omission when he mailed it to IRS before the October 15, 2001 extended due date.

IRS and the taxpayers both acknowledged that Mrs. Reifler relied on her hubby to handle the family financial and tax matters, including preparation and filing of the tax returns, and that she, indeed, intended to file a joint return for 2000.

In any case, the IRS Service Center returned the 2000 return to the taxpayers because of the missing signature (as is the usual procedure in our experience) though the taxpayers claim there was no explanatory information from the IRS regarding why they sent the package back. Mr. Reifler thought nothing of it because he had requested copies of his tax returns from time to time from IRS for various business reasons. But unfortunately, upon receipt of the returned return, the taxpayers did not subsequently send the original return back to IRS with the requisite signature.

Sooooo, in 2002, IRS issued a delinquency notice to the taxpayers, informing them that the 2000 return had not actually been received in Uncle Sam’s grubby hands, whereupon the taxpayers then did both sign and return a second copy of their 1040. And it was this second copy which IRS officially accepted as the originally filed 2000 return – albeit delinquent at this point.

The ensuing beef between the taxpayers and the IRS led the parties to an eventual day in the Tax Court, where the taxpayers made two arguments in support of their claim that the original 2000 return (without Mrs.’ Signature) was validly and timely filed.

- They first argued the so-called “substantial compliance doctrine,” claiming that their tax return need not have been “perfect” to be valid, as sanctioned by the Supreme Court previously in the Zellerbach Paper Co. case, noting that if a return “purports to be a return, is sworn to as such…and evinces an honest and genuine endeavor to satisfy the law,” it will be treated as a return.

- The second argument advanced by the Reiflers was based on the so-called “tacit consent doctrine,” premised on the notion that absent Mrs. R’s signature, they truly intended to file a joint tax return.

“No Bueno” concluded the Tax Court on both counts. And indeed, adding insult to injury as

usually happens, the Court also found that the taxpayers did not exercise ordinary business care and prudence in handling the original 2000 return when IRS sent it back, therefore concluding that the failure to file penalty was applicable!

Moral of the story? Make sure that both hubby and wifey sign before they seal and deliver!

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments at [email protected].

When is IRA Contribution Deductible?

Not really a trick question – the law permits deduction of an IRA contribution in the tax year it is actually made – with one little modification: you can still deduct your 2015 contribution, f’rinstance, if you deposit it no later than April 15, 2016.

So here come taxpayers Mr. and Mrs. Stephen J. Dunn – he a tax lawyer, no less – to butt heads with the Tax Court on this question. During the first part of 2008, Dunn was employed by a private law firm, and was an “active participant” in that firm’s qualified retirement plan. (He became self-employed in late 2008 and remained self-employed through the end of 2010.) Recall that for taxpayers with incomes above a certain level, IRA contributions are not deductible when one is an “active participant” in an employer plan. Nonetheless, Dunn claimed a deduction for his IRA contribution in 2008. Upon audit, the Revenooers disallowed the deduction because of the “active participant” status. But the taxpayer concocted the somewhat novel argument that the 2008 IRA contribution was an “excess contribution” which could be carried forward or, alternatively, should be deemed to have been made for 2009.

“No dice” concluded the Tax Court. Each IRA contribution year stands on its own. And, adding insult to injury, clipped Dunn for the “accuracy-related penalty,” based on the fact that as an experienced attorney, he should have known better that his arguments “have no support in the Code, the regulations, relevant case law, or basic tax principles.”

So there.

And we were struck by the common sense words of Thomas Sowell, the Rose and Milton Friedman Senior Fellow on Public Policy at the Hoover Institution, as published in the Fall 2015 edition of the Hoover Digest. To wit:

“In a recent panel discussion on poverty at Georgetown University, President

Barack Obama gave another demonstration of his mastery of rhetoric—and

disregard of reality……In Obama’s rhetoric, those who produced the wealth

that politicians want to grab……are called “society’s lottery winners.” Was Bill

Gates a lottery winner? Or did he produce and sell a computer operating system that allows

billions of people around the world to use computers, without knowing anything

about the inner workings of this complex technology? Was Henry Ford a lottery

winner? Or did he revolutionize the production of automobiles, bringing the price

down to the point where cars were no longer luxuries of the rich but vehicles that

millions of ordinary people could afford, greatly expanding the scope of their lives?

Most people who want to redistribute wealth don’t want to talk about

how that wealth was produced in the first place.

They just want “the rich” to pay their undefined “fair share” of taxes. This share

must remain undefined because all it really means is “more.” Once you have

defined it –whether at 30 percent, 60 percent, or 90 percent—you won’t be able

to come back for more.”

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments at [email protected].

Lois Lerner Skates

No surprise here – Obama’s Justice Department declared, just the other day, that IRS (in the person of the now famous Lois Lerner) really did nothing nefarious in its myriad investigations and scrutiny of various nonprofit “Tea Party” groups relative to their tax exemption applications. Obama’s boys have decided that there will be no charges filed against Lerner, or anybody else amongst the Revenooers.

According to Assistant Attorney General Peter Kadzik, Justice has found “substantial evidence of mismanagement, poor judgment and institutional inertia leading to the belief by many tax-exempt applicants that the IRS targeted them based on their political viewpoints. But poor management is not a crime……We found no evidence that any IRS official acted based on political, discriminatory, corrupt, or other inappropriate motives that would support a criminal prosecution. We also found no evidence that any official involved in the handling of tax-exempt applications or IRS leadership attempted to obstruct justice. Based on the evidence developed in this investigation and the recommendation of experienced career prosecutors and supervising attorneys at the department, we are closing our investigation and will not seek any criminal charges.”

So there.

The conclusion obviously leaves Darrell Issa (R-California) cold after his House Oversight Committee spent a few years chasing all of this down.

“The Justice Department’s decision to close the IRS targeting investigation without a single charge or prosecution is a low point of accountability in an administration that is better known for punishing whistleblowers than the abuse and misconduct they expose.”

And more IRS news came down last week – good news, the Revenooers say, for we and thee: new “protections” being put in place for next filing season, relative to preservation of taxpayers’ identity.

Quoth Commish Koskinen, “Joining me today are representatives from the electronic tax industry, the software industry and the states. These members of our Security Summit group have collaborated with the IRS on this effort from day one. We began mapping out a strategy in March, and together we have made significant progress in just a few months……I’m delighted to report that, for next year’s tax filing season, we are on track to fulfill our goal of having new safeguards in place for taxpayers when they file their returns……Most of these new protections will be invisible to taxpayers, but behind the scenes we are putting in place a multi-layered, multi-faceted approach……We’re going on offense like never before.”

Ahhhhhhhhhh, we feel so much better now, secure in the knowledge that IRS is truly on top of things.

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He welcomes comments, and can be reached at [email protected].

Good News/Bad News From Low Inflation Rate

If there’s anything good that may have come from Obama’s actions (or inactions, as the case may be) lately it’s the fact that inflation is little or none in the last year or so.

The bad news, of course, is that Social Security recipients can expect zero in the way of a raise, next year, because any annual cost of living increases arise when the consumer price index moves upward. The good news, however, is that worker bees will experience no increase in the amount of their annual earnings which will be subject to Social Security and Medicare taxes. Thus, for 2016 the combined FICA and Medicare tax rate will remain at 15.3%, paid half each by the worker and his employer. Likewise, there will be no change in the tax rates or earnings base applicable to self-employed folk.

And speaking of FICA, an aspect of this annoying levy has long irked folks whose employment arrangements include their earning of certain forms of “deferred compensation.” And a recent decision of the Court of Appeals for the Federal Circuit (in the case of Mr. Balestra) brings this annoying law front and center.

Seems Mr. Balestra was an employee of United Airlines (UAL) until his retirement in 2004. He had earned some “nonqualified deferred compensation” which had not been paid as of his retirement date, upon which date the full present value of his deferred comp was included in the FICA tax base, resulting in FICA withholding on income which he didn’t receive as of that point in time! And unfortunately, UAL had entered bankruptcy in 2002, two years before our boy’s retirement date. Consequently, of course, UAL’s obligation to pay Balestra’s deferred comp was ultimately discharged, with the majority of the benefits never having actually been paid to Balestra. In 2010, UAL made the final payments to creditors as required under its bankruptcy plan, leaving Balestra essentially out in the cold – no deferred comp, despite FICA having been paid by him!

O tempora, O mores!

Balestra went to Court, seeking a refund of the FICA withheld, but the Revenooers and the Courts told him to take a hike.

Nice.

And finally, this week, we recently learned via The Wall Street Journal that the Tax Foundation’s annual International Tax Competitiveness Index finds that, once again, the U.S. of A. ranks a dismal 32nd out of 34 industrialized nations.

The index measures various factors that determine how “friendly” a government is to business and investment, including the amount of taxation and the complexity of tax rules. While Uncle Sam gets credit for not imposing any sort of “value added tax” over and above all of the other taxes, the U.S. comes in “dead last” among the 34 developed countries in the Organization for Economic Cooperation and Development (OECD) when it comes to taxing corporate income! The U.S. top marginal corporate rate of 39% is a whopping 14 points above the OECD average of 25%!

Don’t laugh, but Estonia again cops the top ranking in this year’s index – with a flat 20% rate on both personal and corporate income – and zero tax on personal dividend income!

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, with offices in Incline Village and Reno. He can be reached at [email protected].

Some Recent Development Which May Affect You

So, we’re into the last quarter of the tax year – no time like the present to start your tax planning, and enhance your awareness of some recent changes in the rules. A few items of importance, starting with some provisions of the recently enacted “Surface Transportation and Veterans Health Care Choice Improvement Act of 2015” (the Transportation Act):

- Partnerships and S corporations must file their 2016 returns by the 15th day of the third month after the end of the tax year – this means March 15 for calendar year entities. This is a change for partnerships, which previously had until the fourth month after year end by which to file. C corporations will have to file by the 15th day of the fourth month after year end – previously the deadline for these entities was the third month after year end.

- Effective for returns required to be made and statements required to be furnished after December 31, 2016, lenders must report more info on mortgages, including the origination date, the amount of outstanding principal, and the address of the underlying property. (More info for use by the Revenooers in potential audits of issues associated with your mortgage loan!)

- IRS will now have six years (instead of just three) within which to audit your return in situations where overstatement of your tax basis (and not just omission of gross income) results in a substantial understatement (2 5% or more) of your taxable income. (The Revenooers had long thought these facts always allowed them the three additional years for audit, but they consistently lost the issue in the courts – including cases before the Supremes – so they now have been successful in their efforts to have the law actually changed to reflect the answer they want.)

Another important recent change, courtesy of the Ninth Circuit Court of Appeals, results in a doubling of the home mortgage interest deduction for unmarried taxpayers, as we recently mentioned. The limitations on the amount of debt eligible for the home mortgage interest deduction ($1 million of mortgage “acquisition debt” and $100,000 of home equity debt) are to be applied on a “per individual” basis, and not on a “per residence” basis as IRS had always thought. Consequently, for unmarried co-owners of a residence, the combined limit for the mortgage interest deduction is doubled from a maximum of $1.1 million to a maximum of $2.2 million! Pretty nice windfall!

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation.

Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He may be reached at 831-7288, and welcomes comments at [email protected].

Busy September Tax Court

The Tax Court was quite busy in September – particularly in hammering taxpayers with a “nice try, but no cigar” conclusion to their cases. Three in particular:

- In Ronald C. Fish v. Commissioner, the taxpayer tried one which has been pled to us on many occasions by beleaguered taxpayers: deduction on the 1040 of losses passed through from partnership investments owned by his IRA. The taxpayer in this case argued that (in his view) an IRA has “all the attributes of a grantor trust and is therefore a pass through entity which makes all items of income, deduction and credit treated as belonging…(to him) and reportable on …(his) individual tax return.” Of course, IRS and the Tax Court did not agree, because clearly transactions occurring within the IRA do not result in taxable events which are reported on the holder’s individual income tax return. The law is quite clear that only distributions from and payments out of an IRA trigger income tax consequences for the payee or distribute. And if you think about it, the taxpayer eventually will get the benefit of the losses – in the form of less dough available within the IRA to distribute to him as retirement income. It’s just that simple.

- And then we have Donald L. Dunnigan v. Commissioner which was another “nice try” on the taxpayer’s part, but to no avail. Seems that Dunnigan obtained a business line of credit to help support his sole proprietorship appraisal business, and he drew $50,000 down on the line over time. In 2009, he was unable to repay the borrowed funds in full, negotiating with the lender to settle the obligation for about $15 grand. The lender ultimately issued a Form 1099-C at year end, reporting the $35 grand as cancellation of indebtedness income, of course, but erroneously checked the box on the form indicating that the taxpayer was not “personally liable” for the debt repayment. So, in preparing his income tax return for the year, Dunnigan improperly relied on the incorrect 1099-C, in addition to concluding that he was exonerated from reporting the income on some theory of “hardship” (due to a medical condition). Unfortunately, neither claim succeeded, in that the incorrect 1099-C was irrelevant, given the actual legal agreement which the taxpayer had signed in the first place, and further, the law does not provide any form of “hardship” exception for health reasons relative to this kind of tax event.

- Finally, in Charles Okonkwo, et ux. v. Commissioner, IRS slapped the taxpayers for trying to deduct a rental loss associated with a house rented to their daughter for less than a “fair market value” rental rate. The Internal Revenue Code is crystal clear in stating that a dwelling unit is used as a residence of the taxpayers (and thus, by definition, a personal use property and not a rental property) if the taxpayers or a family member uses it for personal purposes for more than a defined period of time and/or does not pay fair market value rent. Thus, daughter’s use of the residence in question was personal and is attributed to the taxpayers themselves. Result: no allowable rental loss!

CONSULT YOUR TAX ADVISOR – This article contains general information about various tax matters. You should consult your CPA regarding the implications to your own particular situation. Jeff Quinn, the author of this article, is a shareholder in Ashley Quinn, CPAs and Consultants, Ltd., with offices in Incline Village and Reno. He may be reached at 831-7288, and welcomes comments at [email protected].

Tangible Asset Expensing Limit Set to Expire

Many folks have come to know and love the Internal Revenue Code’s “Section 179” deduction. Under this rule, tangible personal property which would otherwise be capitalized and depreciated over several years can be written off in full in the year the property is purchased and placed in service.

And indeed, the deduction has been quite generous in recent years – allowing taxpayers to deduct expenditures of as much as $500,000 in the acquisition year. But unless Congress takes action to retroactively restore this generous allowance to property purchases after December 31, 2014, the limit drops from $500,000 to $25,000! So if you bought that fancy machine in January or later of this year, get on the horn to your Congressman and insist that he and his cronies extend this provision, lest you be stuck with only a measly depreciation deduction for this year’s expenditure.Read More

“Kiddie Tax” Nuisance

Recall that some dependent children must file a Form 8615 with their tax return, and subject unearned (generally, investment) income to income taxation at his parents’ tax rate. The form must be filed for any child who meets all of the following conditions:

- The child had more than $2,000 of unearned income.

- The child is required to file a tax return.

- The child either was under age 18 at the end of the tax year, or was age 18 at the end of the year and did not have earned income that provided more than half of his support, or was a full-time student at least age 19 and under age 24 at year end and did not have earned income that provided more than half of his support.

- At least one of the child’s parents was alive at the end of the year.

- The child does not file a joint return.Read More

Judge Hammers Obama On Privacy Fishing Expedition

A Federal judge, last week, ordered the Revenooers to turn over the records of any requests from the White House which may have sought taxpayer private info in recent times.

Judge Amy Berman Jackson said IRS cannot simply refuse on the basis of confidentiality laws.

“This court questions whether Section 6103 (of the Internal Revenue Code) should or would shield records that indicate confidential taxpayer information was misused, or that government officials made an improper attempt to access that information,” quoth Judge Amy who denied IRS efforts to close the case.Read More

Court Slaps Private Foundation: Private Inurement

A recent decision of a district court in the District of Columbia agreed with the Revenooers, who actually revoked the tax exempt status of a foundation because some of its activities resulted in extraordinary benefits (“private inurement,” to use the vernacular of the bureaucrats) to the entity’s founder’s family.

Seems a decedent’s estate gave about $2.5 million to a foundation which had previously been put in place. The estate, of course, took a charitable deduction for estate tax purposes, resulting in zero, zip, nada being paid in estate taxes.Read More

Ninth Circuit Liberalizes Mortgage Deductibility For Unmarrieds

The Ninth Circuit Court of Appeals (our jurisdiction) recently reversed the Tax Court and potentially handed unmarried mortgage debtors a significant windfall.

The panel’s decision involved the debt limit provisions – recall that the Internal Revenue Code has long allowed taxpayers to deduct interest on up to $1 million of home acquisition debt and $100,000 of home equity debt. The case of Voss v. Comm. involved two unmarried co-owners of real property. Voss and Sophy are domestic partners registered with the State of California. They co-own two homes as joint tenants – one in Rancho Mirage, California and the other, their primary residence, in Beverly Hills, California.Read More

“Beware of Scammers”, Warn Revenooers

Apparently taking note of ever-increasingly blatant tactics foisted upon we and thee by scammers, IRS recently issued a new warning to taxpayers.

These thieves, you see, pop up by telephone, emails and letters on authentic-looking letterhead, in an effort to trick taxpayers into providing personal financial information, or scare folks into making a payment to the criminal, ostensibly in settlement of the target’s delinquent tax account.Read More